The value of a dollar for kids

As your kids grow up, you’re probably starting to think about how you can teach them about money. After all, money makes the world go ‘round…and kids are part of that world. Even if you’ve never talked to them about money, trust me, they’re thinking about it.

Being reluctant to talk to your kids about money is part of the money shyness that’s part of our culture. It’s rude to ask someone how much they make, how much their mortgage is, or how much they paid for their car. Believe it or not, all of these questions are quite common in other cultures.

Or maybe you’re not hesitant to talk to your kids about money–you’re just not sure where to start. What’s the right age to start developing a healthy money mindset for kids? How can you help your kids understand the value of a dollar? How old should a child be to have their first bank account?

If you don’t teach your child about money, someone else will. It’s important for kids to understand the money values you share as a family before they go out into the world of credit cards, loans, and consumerism.

The top 5 questions kids ask about money

Kids ask questions about everything from “What would happen if I fell into a volcano?” to “Why is that lady sleeping on a bench?” Of course they don’t shy away from asking questions about money.

These are the top 5 difficult questions kids ask about money:

- How much money do we have?

- Do we have more money than our friends?

- If we are rich, can I give money to my friends?

- Does it matter if I do well in school?

- If we have the money to buy it, why can’t I just have it?

Do any of these sound familiar? It’s impossible to answer these questions without understanding your family money values. Once you nail down those values, you’ll be able to ingrain them in your kids and answer whatever questions come.

Should I give my kids an allowance?

It can be difficult to decide whether you should give your kids an allowance, how much you should give them, and when to start giving it to them. Receiving an allowance can help your kids learn how to manage money, but it can also give them the idea that money will simply be given to them.

Another route is to pay kids an allowance that’s dependent on their chores. This teaches them that money needs to be earned, often by doing challenging or undesirable tasks. The problem is this: most parents want their kids to contribute to the family chores without expecting to receive something in return. It’s important for kids to realize the value of serving others sacrificially.

In my opinion, the perfect solution is to have certain chores that your kids are required to do without being paid (e.g. making the bed, doing the dishes, making lunches, etc.) and others that they are paid to do. For them to get paid, they need to find a need in the house and ask you how much you would pay them to do it. This encourages an entrepreneurial mindset and cultivates a work ethic.

For example, your daughter might notice that the garden is overgrown. She would come to you and ask how much you would pay her to weed the garden. Once you agree on a price, she would go out and get to work.

Whenever you determine that your child is old enough to start earning money (this can be as young as 6), set aside time to decorate three jars together. The first jar is the Save Jar for 25% of their money. The second is the Spend Jar for 50% of their money. The last jar is the Share Jar for 25% of their money.

This is an easy way for your kids to start budgeting at an early age. When they take money from the Spend Jar, try not to limit their purchases (as long as they are safe and age-appropriate, of course). Before long, your son will learn that using his entire Spend Jar at the candy shop was a poor choice. He will understand the power of delayed gratification once he lets his Spend Jar accumulate until he can buy a video game.

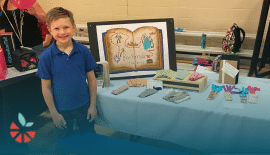

Aside from doing special chores, your kids can earn money by starting their own business. They will gain lifelong skills as they learn how to market to customers and create valuable products. Joining MyFirstSale is the fastest way for kids to start a successful business.

Age-appropriate activities: financial literacy for kids

Age-appropriate activities: financial literacy for kids

Once you’ve figured out how your kids will earn an allowance, you can start thinking about other ways to teach them about money. There are a variety of ways you can do this, depending on how old your kids are.

Financial literacy for ages 3-5

- Teach your child how to recognize, name, and count coins

- Begin using a piggy bank with a small amount of coins

- Let your child handle small cash transactions at the grocery store

Financial literacy for ages 6-8

- Implement the three jars discussed earlier: Save Jar, Spend Jar, Share Jar

- Encourage your child to look for special chores around the house to get paid

- Help your child start a lemonade stand or other business

Financial literacy for ages 9-11

- Dive into the concept of budgeting using the Spend Jar as a basis

- Start talking about careers your child might be interested in and have them arrange interviews with people in those careers

- Transition your child to an actual bank account

Financial literacy for ages 12-14

- Allow your child to borrow from the family in order to teach them about loans and interest

- Be available as an active advisor as your child plays SIFMA’s Stock Market Game

- Encourage your child to volunteer and fundraise for causes they are passionate about

Financial literacy for ages 15-18

- Support your teenager in getting a part-time job or expanding their business

- Start teaching the importance of building credit

- Develop a plan together for college savings

No matter what age your children are, the best way to teach them about money is to start a business together. Being part of the MyFirstSale community will give your kids the tools they need to create their own virtual storefront and start selling. Once they realize how much hard work is needed to earn money, they’ll be inspired to manage their money in a thoughtful way. Get started with MyFirstSale today.

Age-appropriate activities: financial literacy for kids

Age-appropriate activities: financial literacy for kids

Wearable

Wearable