Kids, why do you want to start your own business?

When we ask kids this question, the number one answer is they want to make money. There’s nothing wrong with that. That’s a great way for kids to become productive adults.

We also have to acknowledge that money management can be difficult to navigate. It’s essential that kids develop a healthy money mindset early so they can carry that with them throughout their lives.

Take stock of your money habits

Kids, have you ever thought about how you treat money? You probably haven’t had much experience managing money yet, but it’s important to start being aware of your money mindset while you’re still young. After all, money management will be a big part of your life, no matter where life takes you.

Ask yourself these questions throughout the next few weeks:

- Why did I spend this amount of money?

- Why did I save this amount of money?

- Why did I give this amount of money?

The answers to these questions will give you insight on what your money motto might be–your subconscious beliefs about money.

The awareness tool

Franco Lombardo suggests using the awareness tool to evaluate why you treat money the way you do. Once you use the awareness tool, you’ll be ready to discover your money motto.

First, determine which event had the biggest impact on you. For Franco, it was being bullied as a child.

Next, figure out what this event made you think about yourself. Being bullied made Franco believe there was something wrong with him.

Then, get in touch with your feelings surrounding this event and the beliefs you adopted because of it. Franco felt anger, shame, and despair and believed he could never fit in.

These beliefs and feelings may have given you a subconscious attitude about money. Franco thought, “If I make a boatload of money, then I’ll fit in and people will love me.” This led him to fill his house with expensive things that he eventually realized were meaningless. At one point, he had 300 ties. Why? He thought it would help him fit in.

Remember, your wound could make you a lot of money if you make an effort to heal the wound and then use it to serve others. Of course, healing your wound is important regardless of how much money you can make from it.

Whatever your subconscious belief is, you need to acknowledge it before you can change it. The awareness tool can help you do that. It also points to the money motto you might identify with.

What’s your money motto?

What’s your money motto?

According to Franco, there are four money mottos that most people resonate with. Take a few minutes to think about which one applies to you.

- Investor

This person invests their time and money, knowing one day they’ll get a return. The investor constantly analyzes their financial situation and looks for opportunities to invest.

- Spender

This one spends their money and relationships, eventually draining them. Another kind of spender is a self-spender who gives away their resources, time, and money. The self-spender says they do it for others, but in reality they’re a martyr who wants to receive something in exchange for their “selfless giving.”

- Valuer

This person looks after their possessions, businesses, and relationships. They have a protective mindset that can turn into hoarding if left unchecked.

- Afraid

This one believes they don’t deserve money or relationships. They cling to what they have and refuse to let go. Anxiety is the driving force behind their life.

Do any of these sound familiar? If you can’t pinpoint which one is your money motto, return to the awareness tool to help you.

How can you change your money motto? You need to get to know yourself and your feelings. Only then can you overcome your natural tendencies and develop a healthy money mindset.

Money and relationships

You may have noticed that each money motto mentions relationships as well as money. That’s because the way you treat money and the way you treat your relationships is completely intertwined.

Franco says, “Collaboration is key. Find people you trust and collaborate. Don’t focus on the money. Focus on how you can serve and make a difference. Create a solution to a problem you have….because others have that same problem. My problem was not feeling safe, so now I help wealthy families feel safe.”

Don’t fall into the trap of spending most of your life making money so you can be happy later on. Invest in your relationships so you can be happy now.

If you haven’t realized it yet, money is simply a tool. Money can be great…or money can ruin you. It’s not about how much money you have. It’s about how you handle your money.

Kids, if you’re always thinking about how you’re going to become a millionaire, it’s time to start thinking about a path to get there. Ask yourself these questions:

- Who loves me?

- Who is my community?

- Who do I want to surround myself with?

- How can I be a great friend?

- How can I serve those around me?

Remember, you turn into the people you spend your time with. That affects your wealth and your life more than anything else. Focus on your relationships now…and the money will follow.

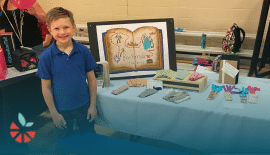

Begin your journey towards investing in relationships by starting your own business with MyFirstSale. Our community will support and guide you as you embark on this money-making adventure. Know this: you have what it takes to be successful and we believe in you.

What’s your money motto?

What’s your money motto?

Wearable

Wearable